Xero Tax is ready for action

Australian tax return forms for 2017 are now available to all 3000-plus registered agents using Xero Tax following a successful two week beta release to gold and platinum Xero partners.

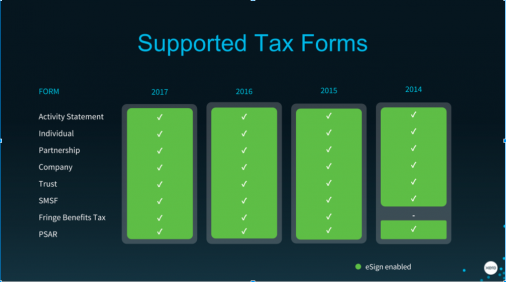

As of today, all the 2017 tax return forms – individual, partnership, company, trust and SMSF – are available within Xero Tax. Registered agents can also use Xero Tax to lodge payment summaries and business and instalment activity statements with the ATO.

The ATO will begin accepting lodgments from 1 July.

If you prepared a client’s 2016 tax return using Xero Tax or Xero Practice Manager, the previously entered details, schedules and carried forward amounts will automatically roll over into the 2017 tax return.

Ready for business

Xero Tax is a tax lodgement solution for accountants and bookkeepers based in Australia. Just like Xero client accounting software, it’s entirely cloud-based. It uses the ATO’s newest PLS technology to lodge and submit activity statements and tax returns on behalf of clients. It’s a benefit of the Xero partner program, available for free to all those certified bronze and above. Consequently you can use it by itself or integrated within Xero Practice Manager.

We’ve built a proven, stable platform with all of the major tax forms (individual, partnership, company, trust and SMSF) available for the 2014–2017 tax years.

Tax time 2017 changes

The ATO has made a few changes to the tax forms for the 2017 income year and we’ve incorporated them into Xero Tax. The major changes this year include:

- In most cases they have expanded small business concessions for businesses with a turnover of up to $10 million.

- There’s support for foreign non-resident capital gains tax.

- A non-resident foreign income schedule supports collection of HELP/TSL/SSL and SFSS debts from permanently departed students.

- Dividend and interest schedule data now rolls forward into the 2017 company return.

- They have introduced additional business worksheets to the 2017 individual tax return.

- You can import SMSF return data via XML from BGL 360, Class Super or SuperMate

Read the complete Xero Tax 2017 release notes

Introducing multi-return jobs

We’ve also streamlined the tax return workflow for agents using Xero Practice Manager. You can create and lodge income tax returns for multiple related clients from a single job.

For example, if your clients operate a family business and you prepare income tax returns for the trading entity and the connected individuals, you can now create all of the income tax returns for all entities from a single job. Simply select the client you are ultimately invoicing and create a new job.

From the job, click on the New Return button and choose the relevant taxpayer from the Related Clients dropdown list. If the taxpayer is a member of the same client group or has a relationship with the invoicing entity, then it will appear in the Related Client dropdown list. Just choose the required tax form type and year and you’re good to go.

The same logic applies for clients where a relationship connects them.

Turn on Xero Tax

If you’re not already using Xero Tax, get started via the recently updated web page.

To support the more than 3000 practices using Xero Tax and the hundreds more planning to switch this tax season, we’ve launched a free weekly intro to Xero Tax webinar on Xero U for all partners.

And we’ve relaunched Xero Tax in Action, our 15-part live training series for Xero partners planning to use Xero Tax for 2016-2017 income tax returns. You can register for Xero Tax in Action today.

The post Xero Tax is ready for action appeared first on Xero Blog.

Source: Xero Blog