The ATO’s Simpler BAS means compliance will get even easier for small businesses using Xero

Many of you will have heard of the ATO’s plans to make it easier for small businesses to complete their BAS (Business Activity Statement) with a Simpler BAS. As the ATO start to release details around Simpler BAS, we thought it’s a good time to let you know how we will keep you up to date with these changes. If you haven’t heard of it yet, fear not as the ATO will be in touch with more details soon!

What is Simpler BAS?

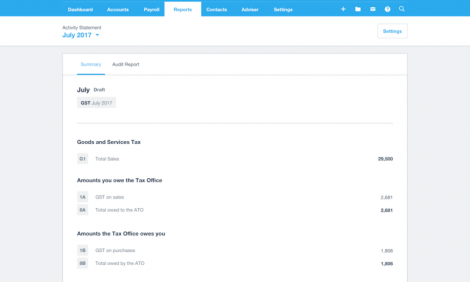

Simpler BAS will reduce the number of GST labels that you have to complete when you report GST to the ATO. With Simpler BAS you will only need to complete:

- G1 for your total sales

- 1a for the GST amounts you collected

- 1b for the GST amounts you’ve paid

The other G fields previously required including: Export Sales (G2), other GST Free Sales (G3), Capital Purchases (G10) and Non-capital Purchases (G11) are no longer needed.

The calculation worksheet method used to determine the amounts to report on the BAS isn’t needed with Simpler BAS either.

Some people will also have other obligations they have to report on the BAS such as: Pay as You Go instalments (the T fields), Pay as You Go withholding (the W fields) or other taxes such as Luxury car tax, Fuel tax credits or others. If you have additional reporting obligations, you’ll report them on your Simpler BAS, just as you did before.

If you haven’t heard from them already, the ATO will be providing more information so keep watch on your email inbox or check out their website.

How are we supporting the change to Simpler BAS in Xero?

We’re developing a whole new BAS experience in Xero to support Simpler BAS and future enhancements. The new BAS also removes the calculation worksheet we no longer need (this is great news for people that have non 10% GST rates).

The new BAS will also give us a strong foundation to deliver our future roadmap plans including supporting direct filing of the BAS to the ATO from Xero and other improvements to make BAS time even easier.

If you still want to use the existing BAS, don’t worry – it will still be available for the time being. As we continue to build out the functionality of the new BAS, we’ll consider when to retire the existing BAS, and keep you updated.

Simpler GST Rates

Given the ATO no longer wants such itemised GST information, this also reduces the need to have so many GST tax rates in Xero. To make it easier in Xero, we’ll let you choose if you want Simpler GST Rates. This will leave you with a basic set of Simpler GST Tax Rates to use on transactions and identify whether it’s BAS Excluded, GST Free or GST. We’ll archive the more detailed rates neither you or the ATO need including: Input Taxed, Export Sales, GST on Capital, GST Free Capital and more.

If you choose to use Simpler GST rates, we’ll take care of the mapping for you on things like Chart of Accounts, Contacts, Items, Bank rules, Repeating Transactions, Journals and more. We won’t update any transactions you’ve already posted in Xero and there’s no need for you to change them either.

Whether you use the new BAS or the original BAS, you can use the Simpler GST rates or the original Full rates.

When will all this happen?

Rest assured we’ll have Simpler BAS in the Australian editions of Xero ready for you to do your first Simpler BAS. Simpler GST rates should be available for you to choose to start using for the new Financial Year in July.

If you’re not sure what this means for you and how it might affect how you use Xero, connect with your Xero Certified Adviser. As a Tax or BAS agent, they’ll be able to support you with your GST and BAS needs with a personalised Xero expertise. If you don’t have a Xero certified Adviser, now’s a great time to connect with one to make the most of the changes.

We’re really excited about our plans to make BAS time painless for you and we’re planning to get cracking on that next!

Stay tuned for more announcements, as we get closer to the start date of Simpler BAS we’ll give you further information.

The post The ATO’s Simpler BAS means compliance will get even easier for small businesses using Xero appeared first on Xero Blog.

Source: Xero Blog