STP and finalisation: How to close out the year

If you’ve been using Single Touch Payroll since it launched last July, you know how simple it is to file a pay run: just two extra clicks in Xero. But how do you handle the end of the financial year? It’s traditionally a time packed with administrative tasks such as creating payment summaries for your employers and each worker.

The good news is that Single Touch Payroll eliminates many of these year-end chores. If you’ve been STP-enabled at any point during FY2018-19, that payroll information already sits with the Australian Taxation Office. There should be no need to create PAYGs or PSARs. Employees will find their PAYG info at myGov, and it will be prefilled on their tax returns.

Bookkeepers and BAS agents just need to submit what’s called a finalisation declaration on behalf of the employer. This essentially tells the ATO that payroll is done for the financial year, and the figures that have been lodged are final. It’s as easy as ticking a few boxes in Xero Payroll.

If you’ve made payments during the financial year outside of Xero (e.g., your opening balances) and haven’t been able to report them to the ATO (either by a part year PSAR or STP), you will be able to handle that in Xero. We will offer this ability as soon as June 18 to include opening balances in your STP filings.

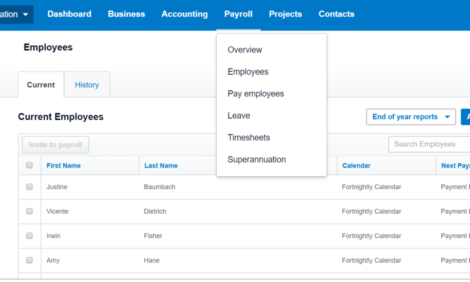

Here are a few images explaining how STP finalisation declaration works.

First, under Payroll, choose Employees. Then select End of Year Reports and STP Finalisation:

This will give you a list of all employees, both current and former. If your client is a larger employer, you’ll discover that STP offers some improvements on PSARs. For example, you no longer need to download an EMPDUPE file and handle that externally. With STP, you can process as many employees as you like at the end of the financial year.

You can opt to finalise all workers at once or select a particular employee.

Another convenient feature of STP is that you can immediately finalise terminated employees. That means less work stacked up for you at the end of the financial year.

“I think the finalisation declaration process is great,” says Jo Doye, director of Bendigo-based Alluvia Financial. “It’s so good to be able to finalise an employee as soon as they leave rather than waiting until year-end. We so often have trouble finding the employees after they leave especially when they change their number or email address.”

Here’s what the screen will look like when you select all employees at once:

Once you’re ready, press Finalise and Submit to ATO.

You’ll then see a screen asking you to verify that you have authority to file on behalf of your client:

If your client has given you an annual standing authorisation, note that it covers only pay runs — not the finalisation declaration. So be sure to obtain this authority before you submit a year-end declaration to the tax office.

When ready, press Submit to ATO. And voila! You should see a screen confirming that you’re done.

But wait! What if you’ve declared and realise you need to go back in and change some payroll figures? No problem. You can just jump in and do another pay run to make the adjustment, and then re-finalise the employee or employees.

And there’s no limit on how far forward or backward in the current financial year you can go with an unscheduled pay run. That’s true even if the employee has been terminated.

You can find year-end deadlines and more information on this ATO page. And be sure to check out Xero’s webinars on closing out the year in STP; we be holding six sessions across June and July, so register now!

The post STP and finalisation: How to close out the year appeared first on Xero Blog.

Source: Xero Blog