Complete the picture with bank data in Xero HQ explorer

The more data you have, the better the connections you can make. That’s the intention behind the Xero HQ explorer feature. Now practices have the full picture with the addition of bank data.

Insights across your entire practice

Xero HQ explorer gives access to data insights across a practice’s entire client base. Understanding your client base as a whole makes identifying trends and applying those learnings to other clients easy.

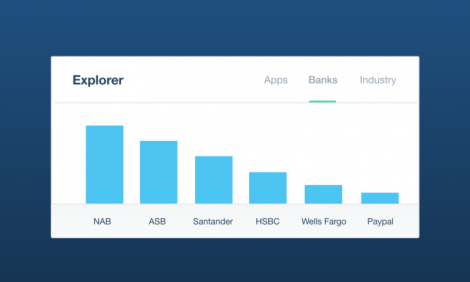

With explorer, practices have the ability to view their client base in Xero by application, industry and now bank connections. The explorer bank feature surfaces results for all Xero connected clients with direct or Yodlee bank feeds as well as connected Paypal accounts. The addition means practices can now easily understand how their clients’ interactions with banks relate to the industries they work in and the applications they’re connected to.

Advisors connect clients to banks

We spoke to our accounting partners in New Zealand about their relationships with their local bankers. We found that it was strong and, in fact, integral to their business.

Hamish MacDonald, Manager at WK Advisors & Accountants, told us “we like to work as a team. The banker, the client and the advisor”.

“We know how different bank managers work combined with the different offerings that each bank has. So, we can align the bank and the relationships manager to the client’s needs.”

As the most trusted advisors for small business, accountants are uniquely placed to influence a client’s banking choice. Therefore the connection between practices, their clients and banks is naturally strong. From the results of our 2017 benchmarking survey, we estimate that referrals from Xero connected practices to banks in the United Kingdom are more than 130,000 per year. Additionally in Australia we estimate upwards of 240,000.

A survey of New Zealand accountants and bookkeepers found that 63% of practices currently have an active working relationship with a business banker.

Building stronger banking relationships

The Xero HQ explorer gives advisors the ability to identify the banks which are most commonly used by their clients. This means they don’t have to individually interrogate each one. This offers further advantages for practices, clients and the bankers who serve them.

On a base level, this helps a practice understand which banks are most popular in their area of work. They can then compare this to industry and application. For example, an advisor with some agriculture clients may discover that one bank is popular than another for that type of industry.

This can act as a prompt for advisors to connect with the local business manager of that bank. They can also prioritise other banks they may need to grow stronger relationships with. Knowing that upwards of 30% of advisors may not have connections with any banks at all presents a substantial opportunity.

The value of being connected

The benefits of pursuing stronger connections with your local bankers are three-fold. Firstly, a closer relationship with banks can mean more benefits for clients. For example, Scotty Jenkin of Noone Plus tells us they often work closely with local banking partners to resolve cash-flow issues for clients.

“When there is the occasional customer that has a cash flow need, for example, they might not have income in the pipeline, we proactively approach our local business banker to let them know the small businesses’ needs and together we make a plan to help sustain the customer.”

The bank also benefits from a much closer understanding of their clients. This enables much faster finance arrangements and better overall packaging of products for a small business.

And of course, it provides new opportunities for the advisor to proactively add value to their clients. For example, bringing banks closer to budget forecasting helped WK Advisors & Accountants identify the best financial products for their clients.

“The bankers are able to support the small business based on up-to-date data and it’s a way they can keep the customer happy and retain them as clients”, explained Hamish MacDonald.

A complete picture to drive your practice

The Xero HQ explorer feature gives advisors a clear understanding of which banks clients are connected to and how this relates to their industry and app connections. Advisors can then identify the bank most commonly used by clients in a related industry. If they don’t already have a relationship they can then take proactive steps to better connect with them.

Often advisors will have clients in different industries who all use different apps and banking services. Xero HQ explorer helps advisors to understand what clients have in common so they can offer advice to similar clients. With that knowledge in hand, practices have a clear view of how to increase their advisory role. They can then figure out where to best focus their efforts next.

As John Curley of Peacocke Accountants puts it, “having a good relationship with your local banker allows you to have frank, open conversations. You can put all your cards on the table and build a plan together that is best for the small business”. In other words, it’s all about better collaboration.

Xero HQ is free to all Xero Partners. If you’re already a Xero HQ user, click here to login and start exploring or; learn more about Xero HQ here.

The post Complete the picture with bank data in Xero HQ explorer appeared first on Xero Blog.

Source: Xero Blog