Introducing PLS – the fancy new name for SBR

Over the past few months, the Australian Taxation Office (ATO) has been gradually rebranding their Standard Business Reporting (SBR) platform and renaming it to Practitioner Lodgement Service or PLS. Registered tax and BAS agents have been advised by the ATO to contact software providers and check that their tax software is PLS enabled.

If you are among the thousands of Australian registered tax and BAS agents using Xero Tax then you have nothing to worry about. PLS is just a fancy new name for SBR – and Xero Tax has used SBR to lodge all activity statements, FBT and non-individual income tax returns since day one.

A little backstory

Five years ago, the ATO signalled that the Electronic Lodgment Service (ELS) that had powered desktop tax software since the late Eighties was going to be gradually decommissioned and replaced with SBR technology. Long term, SBR would enable a wide range of new interactive services that would allow practices to assist clients without relying on the ATO Agent Portal.

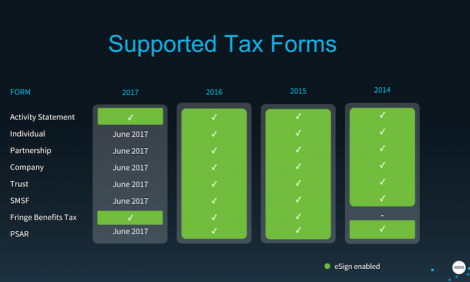

We started work on Xero Tax in 2012 and released SBR enabled activity statement lodgment and payroll forms in 2013. The ATO and Xero then piloted an SBR version of the 2013 company tax form which was released in October 2013. As each new form was gradually SBR enabled, they were developed by Xero and released to our partners – partnership, trust, FBT and SMSF.

Today we are the largest consumer of the SBR platform with more than 2 million lodgments since 2013. We have been actively working with ATO on the ongoing design and development of the SBR/PLS platform and have established ourselves as the leading, mainstream provider on the new platform.

What about the individual tax return?

Mid last year, the ATO released the first version of the 2016 individual tax return that was SBR enabled. Many software developers including Xero had concerns about the performance of the SBR version of the individual return at tax time so Xero Tax remained on ELS for 2016 individual returns.

One year later, the ATO has greatly improved the scalability and reliability of the ITR under SBR and recently announced they will switch off ELS for individual tax returns on 31 March 2018. We will migrate the individual tax return (2014, 2015, 2016 and 2017) to PLS later this year. Until then, registered agents will need to be registered for ELS to prepare and lodge individual tax returns.

Don’t worry. This will be a seamless migration and registered agents won’t need to do a thing. Ultimately, for practitioners the transition from ELS to SBR is akin to replacing 3G mobile phone towers with 4G ones. It will happen and it will just keep working.

Learn more about Xero Tax

With tax time approaching and over 3000 practices going paperless and using Xero Tax everyday, we are launching a free weekly Intro to Xero Tax webinar on Xero U for all partners. We have recently updated our dedicated landing page and have just relaunched Xero Tax in Action – our 15 part live training series for Xero partners using Tax for 2016 and 2017 income tax returns. To register for each session, just search for “Tax in Action” on Xero U.

The post Introducing PLS – the fancy new name for SBR appeared first on Xero Blog.

Source: Xero Blog